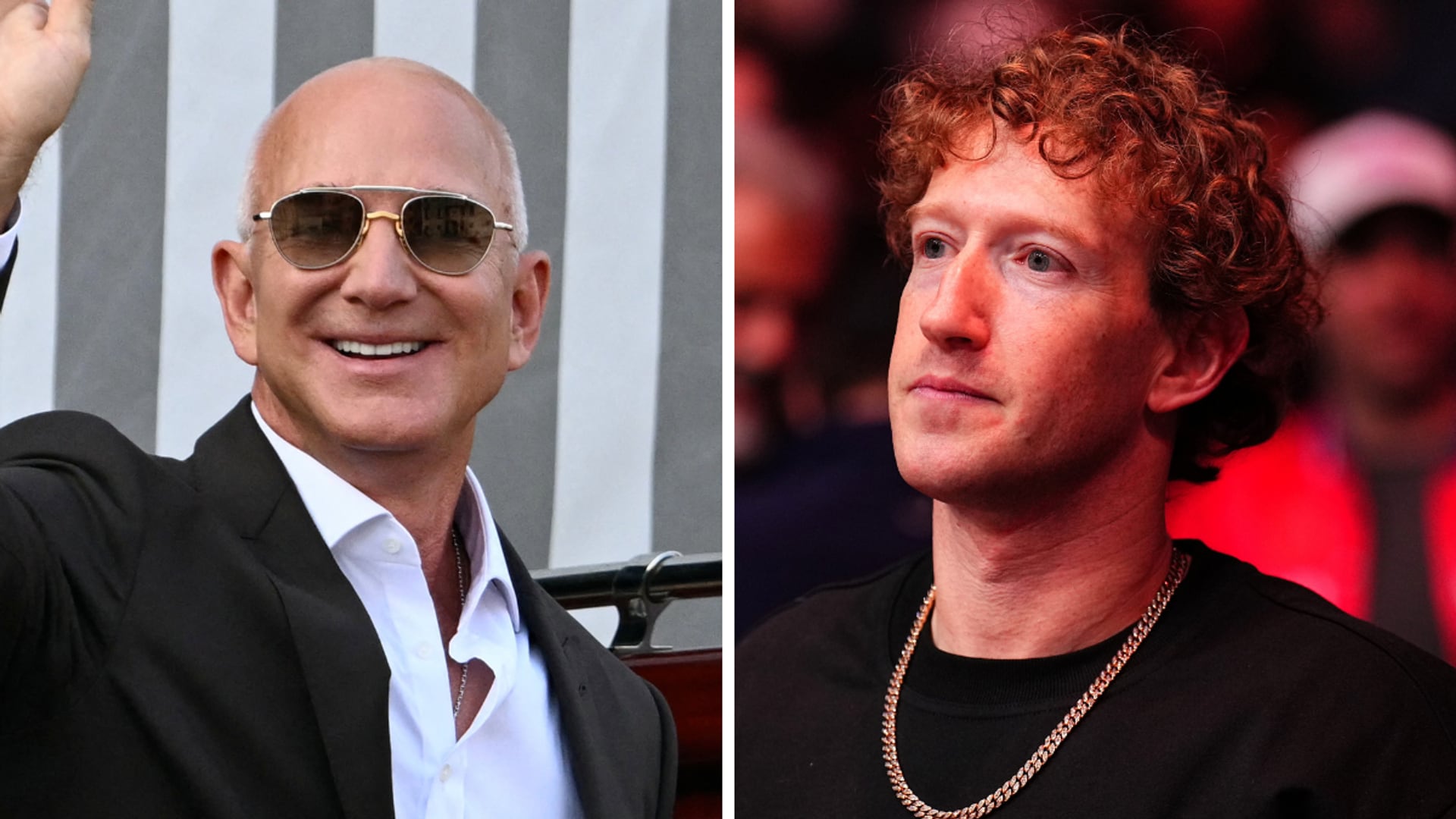

In a headline-grabbing shuffle of billionaire rankings, Meta CEO Mark Zuckerberg has officially leapfrogged Amazon founder Jeff Bezos to become the second richest person on the planet, according to the Bloomberg Billionaires Index.

As of Wednesday, Zuckerberg's net worth hit $225 billion, narrowly edging out Bezos at $223 billion. Still in first place is Elon Musk, who leads the pack with a whopping $370 billion.

But this isn't just about bragging rights. It's a snapshot of how investor sentiment, tech sector volatility, and the race for dominance in AI are reshaping personal fortunes and the future of the digital economy.

Why This Billionaire Shake-Up Matters

This latest shift in tech's financial hierarchy is more than just a scoreboard update for the ultra-rich. It signals a deep confidence in Meta's current strategy, especially in artificial intelligence and digital advertising. These sectors are not only reshaping how we use the internet, but they're also defining where Wall Street places its biggest bets.

While Musk, Bezos, and Oracle's Larry Ellison have all seen drops in net worth this year, Zuckerberg has surged ahead with a $17.3 billion gain since January 2025, thanks almost entirely to Meta's stock price rally. With a personal stake of around 13% in Meta, Zuck's fortune is tethered to the company's market performance, and right now, that bet is paying off.

Powered by AI and Ad Dollars

So why is Meta flying high while others are feeling the burn? In the first quarter of 2025, Meta reported $42.3 billion in revenue, marking a solid 16% increase, while net income skyrocketed 35% to $16.6 billion. The secret sauce has the secret ingredient of AI-driven ad tools that have supercharged delivery optimization and ad pricing, giving Meta a clear edge in digital marketing.

These tools quietly revolutionize how brands reach customers, and investors buy in. Meta stock has climbed nearly 9% year-to-date, closing Wednesday at $635.50 per share, reflecting its financial health and future potential.

Meanwhile, Over at Amazon

Bezos, still the largest individual shareholder in Amazon with nearly 926 million shares, hasn't had quite the same year. While Amazon is no slouch in cloud computing and logistics, its stock is down 8.33% in 2025 and closed at $201.12 per share.

Amazon did post a respectable 9% growth in net sales last quarter, bringing in $155.7 billion, with AWS (Amazon Web Services) revenue up 17% to $29.3 billion. But rising costs, tariffs, and margin pressures have held back bigger gains, making investors slightly more cautious, at least in the short term.

Despite this, Amazon's long-term bets on global logistics, e-commerce, and cloud infrastructure still give it a dominant edge in digital retail and enterprise computing. But for now, it's Zuckerberg who's enjoying the market spotlight.

The Billionaire Index Is a Tech Barometer

These billionaire rankings aren't just a playground scoreboard. They mirror larger market trends, particularly around AI, ad tech, and investor appetite for innovation. When fortunes shift by billions, it reflects how quickly markets can pivot and which narratives investors buy into.

It's also a sign that Zuckerberg's vision for Meta's future, centered on AI, monetized attention, and possibly even the metaverse in the long game, is gaining traction again after several years of turbulence and skepticism. At the same time, Elon Musk remains far out in front, even after losing $62.2 billion in 2025. This is a reminder that Tesla and SpaceX still capture the market's imagination, even when the stock market doesn't fully cooperate.

The Race Isn't Over

Zuckerberg's rise to #2 shows how fast the tech tides can turn. His climb is fueled by strategic innovation and investor faith in AI's role in reshaping digital life. But this leaderboard is anything but fixed.

With earnings season in full swing, AI innovations rolling out rapidly, and regulatory pressures looming, the next shift could come just as fast.

Still, for now, Mark Zuckerberg is the man to watch, not just because of his bank account but also because of what Meta's success reveals about the future.